Before the pandemic, telehealth was rather the exception in Poland. In 2017, only 7%- of the population used medical services via the internet (EU-average: 13%).

Despite legal permission for telemedicine and public ehealth infrastructure at European level, yet challenges remained in the form of HC-professionals' cultural attitudes and lack of digital literacy and knowledge about telemedicine services.

The implementation of telehealth was accelerated by two major crises: the COVID pandemic and the Ukrainian War and refugee crisis. Poland is now an emerging and growing market for telehealth in Europe.

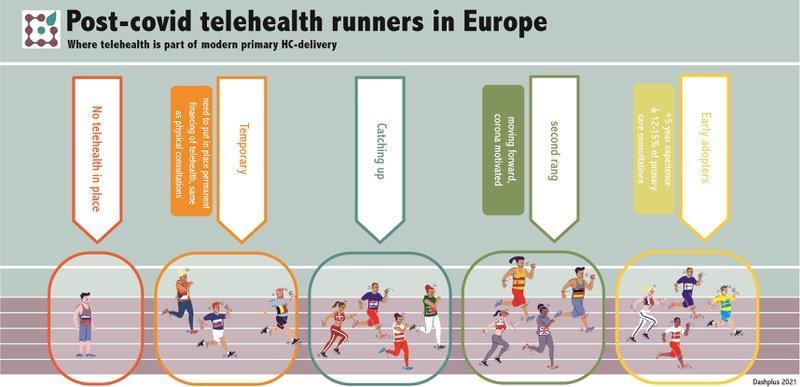

In our blog on telehealth in Europe since the pandemic, we indicated Poland is catching up with Europe’s first adopters.

Let’s take a closer look at that. In this blog, we analyse the Polish health system challenges and market maturity for telehealth.

Click here to buy the full report on telehealth in Poland: ‘The emerging telehealth landscape in Poland’

Poland's health system challenges

Poland is the 5th EU-country in terms of population. With its 38 million inhabitants (2022) it’s listed after Germany, France, Italy and Spain. The health system is categorised as Bismarck, with hospitals being publicly financed (by the NHF-national health fund) and most outpatient care being private.

There’s a fundamental shortage of doctors and nurses in Poland: both are the lowest per 1000 inhabitants in Europe. Poland has 2,4 practising doctors per 1000 inhabitants and 5,1 practising nurses. This has an impact on accessibility of care, mainly in more rural regions. In 2019, 4,2% of the Polish population reported unmet needs for medical examinations due to either costs, distance or waiting times (the EU-average was 1,7%).

Next, there is an issue of inadequate coordination and integration of health care, as hospitals are prioritized over outpatient care, long-term care, and diagnostics. (OECD-country profile 2021).

39% of Polish people reported having at least one chronic condition in 2019, and cancer mortality rates are 30% higher for men and 20% higher for women than EU averages, indicating problems with timely diagnosis and treatment (OECD-country profile 2021).

The heavy burden of cronic conditions increased the risk of severe complications from COVID-19. Poland was one of the countries in Europe being impacted the most by the COVID19 pandemic.

In 2022, an additional challenge was added due to the war in Ukraine: a refugee influx of 7.5 million people and 1 million Ukrainians settling in Poland, who all need healthcare, medications, and support.

Telehealth and healthtech to the rescue

Since the covid pandemic, telehealth and healthtech have been helping to save Poland's healthcare system:

- GP consultations could continue via phone or video, and this was widespread in Poland: 80% of all visits were made via telehealth

- 61,9% of all Polish patients received a teleconsultation in 2020 and 2021. This is the 3rd highest number in Europe (after Spain and Slovenia)

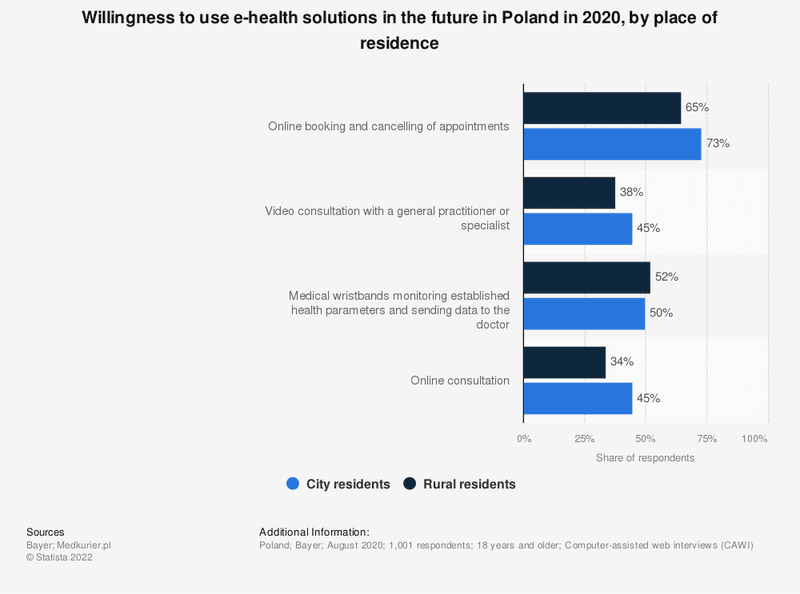

- 87% of all patients using telemedicine evaluated the TM services positively, 60% supported online pharmacies and 38% videochats

- The health4Ukraine program, funded by DirectRelief, polish HC company Pelion, Red Cross Poland, ING and Deloitte foundation in Poland, has connected more than 270 000 Ukrain refugees in Poland to health care and medications via telehealth. The private telehealth platform Dimedic is open for registrated participants to the Health4Ukraine program, to receive medical advice and prescriptions by doctors who speak Ukrainian. Plus people can buy medicines, medical devices, .. in over 50% of Polish pharmacies, free of charge, with their participation code. The first participant was registered by the end of April 2022.

Telehealth market maturity has been affected by this.

Read all about telehealth in Poland in our report: The emerging telehealth landscape in Poland

Analysing maturity of Poland’s telehealth market

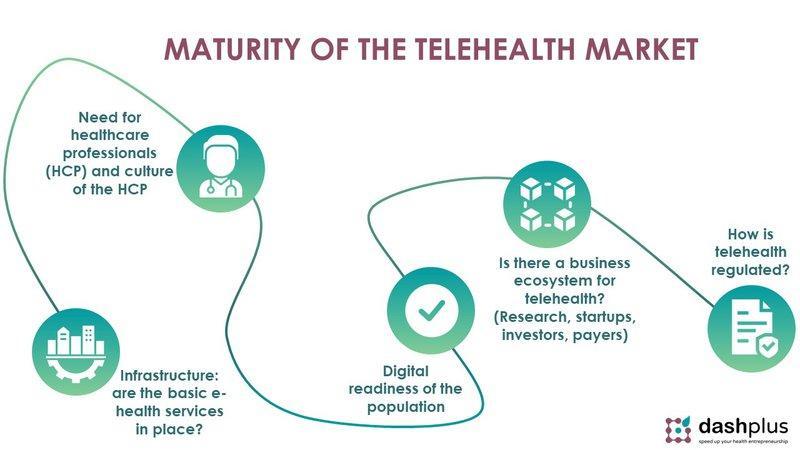

We will assess market readiness for telehealth using 5 factors:

- need for healthcare professionals and culture of the HCP

- demographic context and digital readiness of the population

- is there a business ecosystem for telehealth? research, startups, investors, payers

- how is telehealth regulated?

- infrastructure: are the basic e-health services in place?

1. Need for healthcare professionals and culture towards telemedicine

Healthcare providers are often reluctant or to slow to accept novel telemedicine services. But in 2018, research revealed that 62% of Polish primary health care unit physicians were in favor of teleconsultations with patients and 66.6% expressed interest in teleconsultations with specialist doctors, particularly cardiologists. However, 55.9% of respondents stated they were not technically prepared for this type of communication.

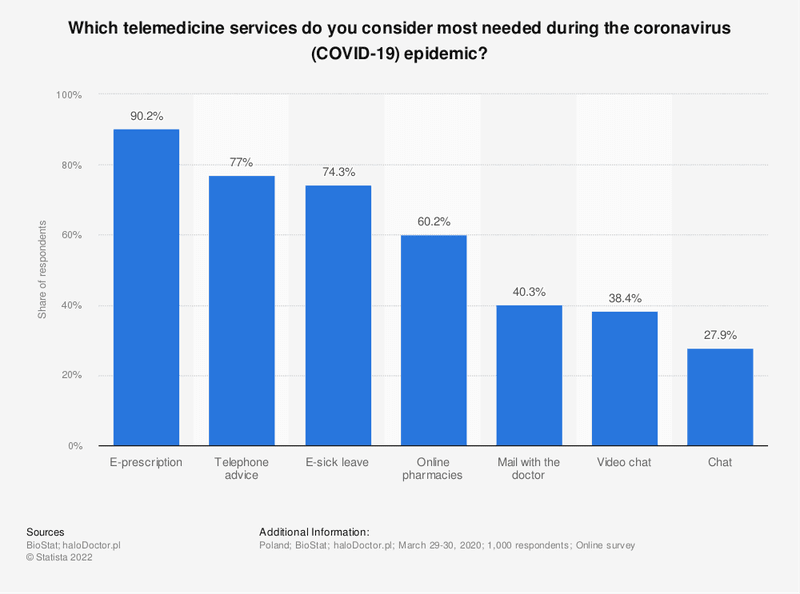

Health care professionals (HCP) and citizens alike view e-prescriptions as the most essential telemedicine service. According to research conducted by Biostat and Halodoctor.pl, 90.2% of the general population identified e-prescriptions as the most important service during the pandemic, with 77% indicating telephone advice and 74.3% citing e-sick leave.

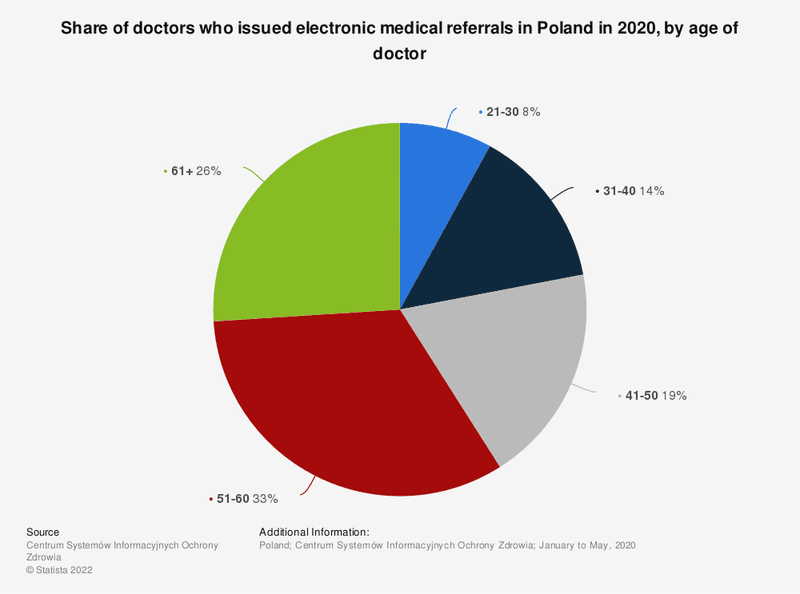

In 2022, 74% of Poles want to use telemedicine for prescription renewal and 58.5% for sick leave. And over 50% of the Polish population thinks referrals (to specialists, rehabilitation or for diagnostic tests) can perfectly be done by telemedicine. Remarkable: it is not younger doctors who are leading the way in utilizing e-referrals, but rather those over 40.

So, openness for basic telehealth services like e-prescriptions, e-sick leave, e-referrals helps further progress of teleconsultations and telepharmacy and teletherapy.

2. Demographics and digital readiness in Poland

The Polish population has an average age of 41.8 years, lower than the EU median of 44.4 in 2022.

The pandemic has made it clear that lack of awareness for telemedicine among the population is not the biggest issue, as almost 62% used telemedicine during the pandemic.

Internet access at home in Poland is on an average EU-level, but is lower in the Eastern parts of the country. The pandemic has helped this too: in 2018 83% of all Polish households had broad internet access at home. This has grown to 92,6% in 2022. 99% of families with children have internet access, the numbers are slighly lower for people in more rural areas and households without children.

But there is a problem of digital skills: only 42,9% of the population has basic or above digital skills, while this is 58% in other EU countries. In 2020, nearly 4 million Poles had never used the internet, and 85% of them are over 55. Older people, living alone, in rural areas and with lower education levels, are typically in this group.

However, there is an opportunity to invest in education and monitoring services since this group has indicated:

- to be open for telemedicine, and especially health monitoring

- the top 3 desired characteristics of telemedicine by older people are alarm button (100%), automatic fall detection (92%) and automatic anomaly detection (83%)

Moreover, it’s clear that the telemedicine can help older people to live independently and reduce the burden on home care workers.

The purchasing power of a relatively young population, as well as the elderly aiming to remain independent while living in their own homes, is expected to drive growth in the telehealth market.

Explore the telehealth market in Poland: go to the report and explore 10+ telehealth companies you should know

3. An interesting digital health business ecosystem

Poland is one of the largest economies in Eastern Europe with a GDP growth rate of 4,9% in 2022 (EU-average: 3,5%). Government is stimulating innovative digital economy and the country has more than 55 promising incubators and accelerators (like Campus Warsaw by Google for Startups).

In 1997 the ‘Polskie Towarzystwo Telemedycyny’ (Polish Telemedicine Society-PTTM) was founded as a research organisation stimulating the development of telemedicine, ehealth and medical virtual reality. PTTM cooperates with medical centres in the country and abroad, it develops opinions and reviews and is involved in the many telehealth conferences in Poland.

The Polish Hospital Federation (PFSz) brings together hospitals regardless of their ownership structure, size or model of operation. PFSz was founded in 2011. PFSz is member of ECHalliance, facilitating multi-stakeholder connections on digital health.

The startup network is dynamic:

- Poland was number 1 in the CEE-region in terms of venture capital rounds and number 2 in invested capital in 2021.

- The tree main startup cities are Wroclaw, Warsaw and Krakow.

- The founders of Polish startups tend to be in their thirties.

- 12% of Polish startups are situated in Medtech, 4% in Foodtech, 5% in Lifescience, 1% in smart home and 21% in AI/machine learning

- Polish medtech sector is growing. Medtech startups are more moving towards commercialisation and 42% of them reported recurring sales revenue in 2021.

- 67% of the startups are cooperating with hospitals

- One of the most successful Polish healthtech companies is Docplanner.

Since 2022, due to some chaotic economic policies, energy crisis, the war in Ukraine and the battle for (ICT-)talent, they experience more difficulties.

Over 130 VC companies in Poland invest in startsups and scaleups. Domestic VC funds and business angels play an important role for startups as 51% of all financing is national. In recent years, significant funding for Polish telehealth startups has came from, among others, EIT Health, Google for startups and Platinum seed. VC funds like Cogito Capital and One Peak invested in multiple Polish health startups.

Poland is the home and location for many (health) startup and digital health conferences, like Impact on 10 and 11 May in Poznan this year (and with tracks on digital, health, mental health and wellbeing, …).

4 and 5. Telehealth regulation & infrastructure

Already in 1996, the Act on the Professions of Physician and Dentist stated explicitely that professional activities of a physician/dentist in Poland may be performed using ICT (Source: DLA Piper). All types of healthcare services may be rendered this way. Obviously, physicians must act with due diligence and follow current state of medical knowledge. If telemedical service is not sufficient from the medical standpoint, then the standard visit should occur.

A new law in 2020 on telehealth in primary care explicitely stated the basic conditions for telemedicine are identical as those which apply for classic care.

Public financing of telemedicine services is for certain types of healthcare services:

- primary care

- outpatient services in oncology

- cardiological rehabilitation

- geriatrics (people +65 years)

In addition, experts call for a system of app prescription (as in Germany) to have more general funding of telehealth services in other medical segments in Poland.

There are no general rules what tools (platforms, apps etc.) should be used while rendering telehealth services.

In recent years, the government has continued to build the necessary e-health infrastructure, such as electronic medical records, e-prescriptions and e-referrals:

- Since 2019, it became mandatory in Poland to maintain electronic medical records

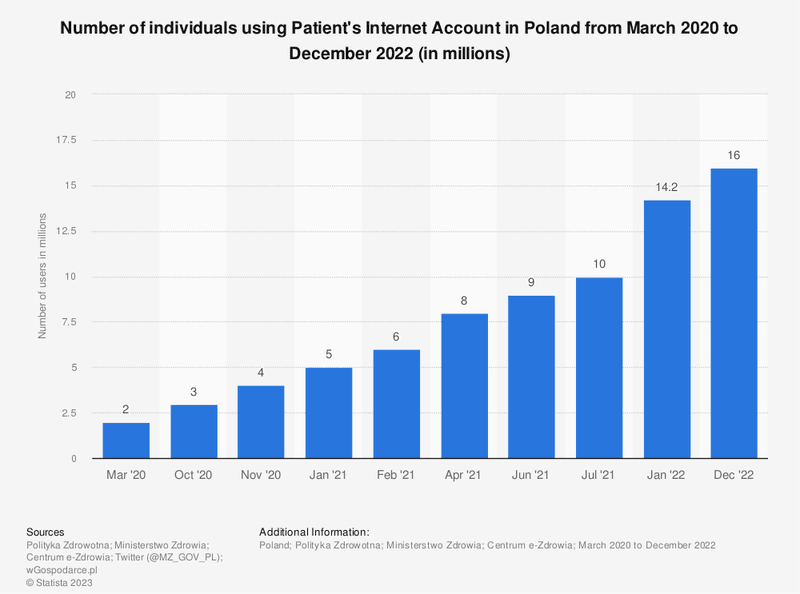

- In 2020 the Patient Internet Account (a patient viewer) was launched and by the end of 2022, 16 million Poles (or 42% of the population) were using the app

- in 2021 it became mandatory to issue e-referrals and to report medical events. (To compare: in Belgium, e-referrals will only be mandatory by 2025).

- Today, under electronic cross-border health services, eprescriptions of Polish patients can be used in Croatia, Spain and Finland. And Polish pharmacist can dispense eprescriptions from Estonia, Portugal, Spain and Finland.

Poland is moving forward to the early adopter group for this part.

Conclusion on the maturity of the telehealth market

Poland is an emerging market for telehealth in Europe. Telehealth was accelerated during the covid pandemic as the need for HCP is particularly high. And after that, it proved to be very helpful for Ukraïn refugees in Poland.

Internet access is on European level, but digital literacy and education is still a problem in more rural areas.

Poland has a vibrant ecosystem in healthtech, with research and professional organisations on telemedicine, with cooperations with hospitals and with interesting startups and scaleups. Most of the healthtech startups are situated in the Krakow and Warsaw region.

Critical ehealth infrastructure for telehealth activities is in place (e-prescriptions, e-referrals, EMD) and Poland is a frontrunner for the cross-border health services.

Telehealth is regulated under the same conditions as classical care, but not all services are publicly funded yet. A telehealth app prescription system could be of help here.

The e-health market in Poland is estimated to be worth 491.4 million dollars in 2022, with an average annual growth of 4.8%. The average annual spend per user on e-health is expected to be 39.36 dollars in 2022. (Source: Datareportal, GWI, Meltwater).

Buy the full report on Poland: ‘The emerging telehealth landscape in Poland’

Thanks to Wouter DC, co-author of this article in the dashplus-team