It’s becoming more and more familiar in the United States and it could be the next big thing in Europe too: hospitals having their own venture fund to invest in digital health innovations.

In this blog post, I explore the world of hospital venturing:

- what are we talking about?

- why is it important to hospitals?

- the forms and requirements of hospital venturing

- what does it mean for health startups and scale-ups?

This article is part of a dashplus-series on healthcare corporate venturing. In the next blog I give 10 examples of European hospitals cooperating with new companies to accelerate change. Don’t miss one or check out all articles on the topic here

What are we talking about?

Hospital venturing is corporate venturing (CV) by hospitals or health systems.

In general, ‘corporate venturing is about structural cooperations with external parties to drive mutual growth. And it’s not only about project cooperation but it adds external investment to it: corporate venturing capital or CVC’ (Omar Mohout and Dado Van Peteghem, 2018).

So hospital venturing is about hospital innovation with external parties in a structured way and with dedicated funding or ‘investment funds’.

Hospitals do have several activities of inside-out innovation, like education and support for intrapreneurs in the organisation. European hospitals are familiar with these.

But when we speak of hospital venturing, it’s all about outside-in innovation. And this is still quite new in Europe but already far more familiar in the USA.

Hospital ventures in the USA

Hospital investment funds first got a foothold in the US-health system already some 15-20 years ago. Since then, these activities have grown exponentially, with over 45 American hospitals managing their own independent investment fund last year, according to Brent Stackhouse at the Frontiers Health Conference in Berlin in November 2019.

One of the oldest and biggest in the field is Ascension Ventures: started in 1999, it manages over 800 million dollars in capital.

Big American hospitals like Mayo Clinic, John Hopkins, Mount Sinaï and Kaiser Permanente invest increasingly in a variety of health IT, medical devices and services. But also mid-size systems like Spectrum Health in Michigan created their own investment fund already in 2017.

Learning from the American experience

European hospitals and health entrepreneurs can learn from the American experience in terms of reasons (why they do it), operational design (how they do it) and the possible impact of hospital venturing (what does it mean for them/result).

If you want to know how European hospitals already cooperate with new companies read ‘here’s how 10 European hospitals cooperate with new companies to accelerate change’

Hospital venturing: why?

Now, you might ask yourself: why would hospital boards be interested in external cooperation or outside-in innovation investments?

Hospitals are huge financial, operational and human resources systems. Secure and continuous medical care is at the centre of their daily activities. All of them deal with complex legal and decision-making structures and many stakeholders.

You don’t need to be an expert to understand innovation takes time within this context. But time is money…

Time is money: reducing waste, delivering better value

Technology changes the world increasingly and rapidly. Healthcare is one of the sectors where huge changes still need to be implemented. Digitally connected consumers change the healthcare delivery chain. And healthcare startups and scale-ups build new solutions in a very dynamic paste.

Slow innovation costs money. In terms of tackling waste in the system, in terms of difficulties with digital uptake and in terms of ultimately leading to a lower value.

Some hospitals in Belgium and the Netherlands, for example, suffer already from huge financial burdens. Hospital venturing is a way to speed up the necessary innovation and to cut down future financial loss.

Be attractive to patients

Hospitals want to be at the forefront of change and offer modern answers to patients needs. That’s one of the main drivers, according to Brent Stackhouse of Mount Sinaï Ventures (USA) as well as to the people of Maria Middelares Hospital in Ghent.

Today’s healthcare customers expect a connection, a partnership with their health professionals. They are looking for flexible and transparent health guidance in the best circumstances.

To a growing extent, these factors of customer centricity and quality will guide the choice of the patient in choosing ‘their’ hospital or doctor. Or in the decision to change to another provider. In this context, pleasant and modern hospital services are on the winning side.

The innovation percentage and impact

According to Harvard Business Review hospital directors should reserve at least 70% of their yearly budget to core activities and 20% to others. A 10% ‘transformation’ or innovation budget will keep hospitals ‘healthy’.

Hospital financing will be based on the innovation percentage and value-based healthcare to a growing extent in the future.

Research shows these forms of financing and cooperation have a positive social impact by increasing at the same time health sustainability and quality of care, especially regarding ‘smart’ (or digital connected) hospital services.

The forms and requirements of hospital venturing

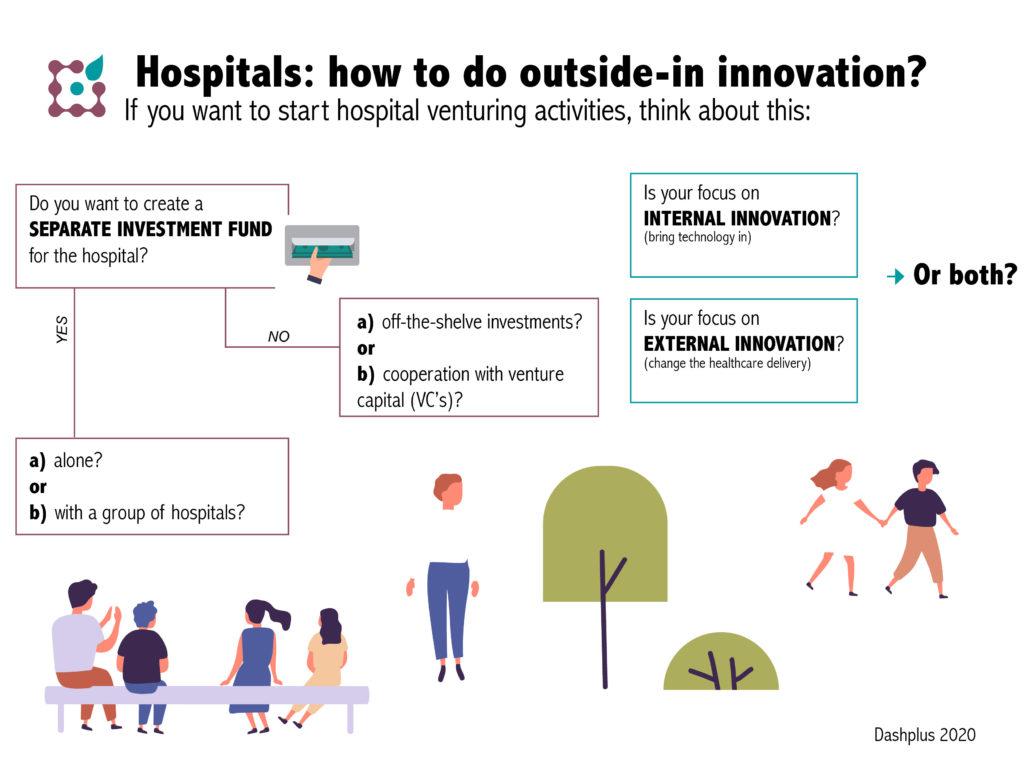

The practice of hospital venturing capital differs from ‘classical’ healthcare investments and is way out of the core expertise of hospital managers. The financial risk is not to push aside.

That’s why, also in the USA, hospitals attracted VC-experts to manage their own separate funds. Sometimes they do this in cooperation with a group of hospitals. For example, Mount Sinaï Venture fund is a cooperation of 8 hospitals.

Or they choose to work with off-the-shelf investments, which is less risky and might seem ‘easier’ for hospitals.

A third form is to cooperate intensively with healthcare VC’s for the financial management of the outside-inn innovation. This is how Israël’s Sheba Medical Center cooperates with Triventures, a late-stage healthcare VC with offices in Israël and USA .

Corporate venturing is becoming the way for hospitals to do outside-in innovation. But the main focus can be on using technology into the whole organisation (internal innovation) as well as external innovation: investing in health startups to change the entire healthcare delivery.

No matter what form they take, their dedicated strategy to speed up the pace of innovation, thus giving better answers to client’s needs and securing their future position in the ecosystem, is what’s at the core of their activities.

This is what successful hospital ventures have in common

Talking about what it takes to build successful hospital venturing activities, this is the first requirement: a dedicated strategy and budget.

You get the idea. What is fundamental here is that mere ‘investing’ in small and loose cooperations or supporting projects is not what we speak of here. That is not future proof hospital venturing. We need something that’s different, with more impact.

Second, pick your focus fields and ignore medical segments. In the next blog post, we’ll dive into some popular focus fields of hospital ventures.

Third, involve team members all over the place. Surprisingly, some of the American hospital ventures started without even a dedicated innovation manager. Every innovation had to be initiated by a staff member; which was difficult to work and slowing down impact. Team members all over the place should be involved in every venture partnership.

Next, document what kind of startups or scaleups you’re looking for. Define your criteria to select partners. To do so, hospitals need to dissociate from familiar procurement habits and documents. These don’t fit the innovation needs.

I’ll return to that point in the requirement-blog of this ‘healthcare corporate venturing’-series too.

Finally, think of other assets you have as a hospital to attract the right startup or scaleup-partners and to make the partnership work out. Think about flexibility and provisions from your software-provider for example. Or about patient support provisions you can offer.

What does hospital venturing mean for healthcare startups and scaleups?

Both for healthcare providers and for startups, hospital venturing is a very interesting trend. For disruptive startups, it turns stakeholders into business partners.

For hospitals, it leads to a first-mover advantage, new expertise and a possible continued low price for the solution. Later on, in turn, this opens possibilities to permanently invest in the venture.

It’s a new way of go-to-market for innovations.

You cooperate as partners and focus together on agreed-upon objectives and metrics. This might lead to a new and larger contract, with continuous value.

Of course, these kinds of partnerships are different from classical sales- and procurement processes. They need other competencies, other relations and new ways of delivering and documenting value.

It’s a new role for hospitals

Digital health investments in the USA is at an all-time high partially as a result of hospital venturing activities. Venture capitalists see startups find hospitals, and this gives trust.

Brent Stackhouse: ‘Hospital ventures can act as a go-between for seed funded startups and venture capital.‘

Plus: there is a market opportunity for new type ‘clinical trials’: digital health trials.

Both of these aspects also apply to Europe. So hospital venturing might be the next big thing in Europe too…

If you’re thinking about hospital venturing activities: here’s a free checklist to see if you’re ready to start.

Want to read the other articles in the healthcare corporate venturing-series? Don’t miss them and subscribe to the FREE dashplus-newsletter.

Would you like to teach your team more about hospital venturing? Please feel free to contact me for a workshop or trusted guidance in your organisation at sofie.staelraeve@dashplus.be