his article is part of a dashplus-series on corporate innovation in healthcare. Next blog will focus on the requirements and impact of hospital venturing. Don’t miss it!

For hospitals, there are several reasons to invest in innovation and they can choose many ways to do so.

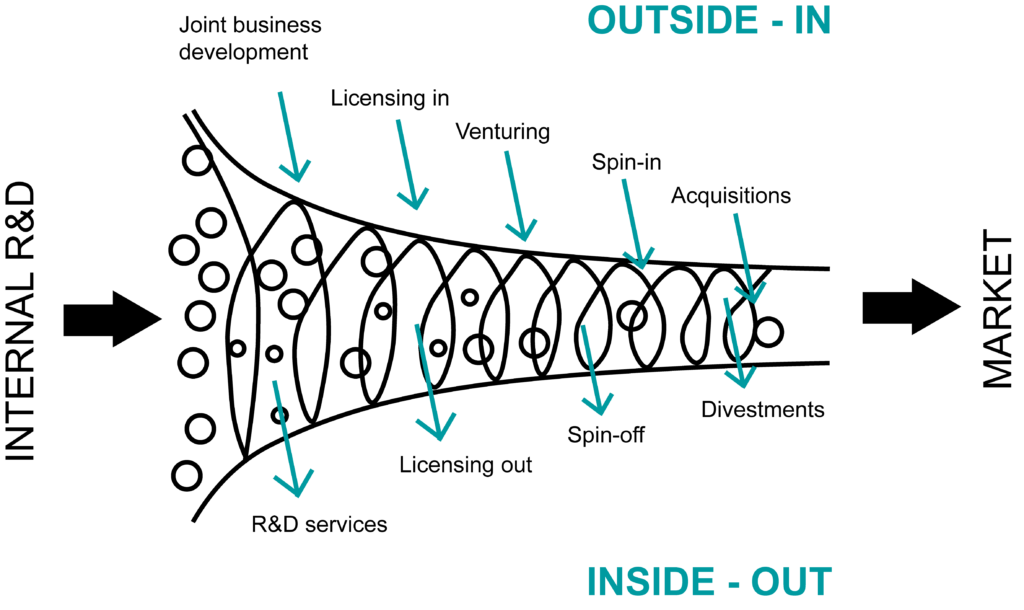

In my latest blog ‘what is hospital venturing and why could it be the next big thing in Europe?’ I explained this as a specific form of open innovation: outside-in innovation.

Corporate venturing by hospitals

Corporate venturing is all about external cooperation to accelerate growth. It’s more than just project cooperation. Corporate venturing is about shared benefits, and often has an investment part in it: corporate venturing capital or CVC (See: Dado Van Peteghem and Omar Mohout, 2018).

Hospital venturing is corporate venturing (CV) by hospitals or health systems.

It’s about hospital innovation with external parties, so outside-in innovation:

- in a structured way

- with dedicated funding

- from of-the shelve investments, an investment fund or intensive cooperation with healthcare VC’s (venture capitalists)

- to speed up the pace of innovation and

- giving better answers to client’s needs

- with the aim to secure their future position in the ecosystem

- situated more at the end of the open innovation funnel: closer to the market and maybe leading to spin-in or acquisitions (by hospital investment funds)

In the USA, hospitals are familiar with the practice of hospital venturing. Over 45 American hospitals even have their own investment fund right now, and they first got a foothold in the US-health system already some 15-20 years ago.

In Europe, hospitals are not yet that far. But the fascination with venturing activities is growing. The reasons for this are clear.

Add the cost of inside-out innovation, consolidation and the creation of hospital networks to this and it becomes even more obvious.

What’s happening right now? Let’s take a look at the venturing activities of some European hospitals.

10 European hospitals and their venturing activities

I’ve made a selection of 10 European hospitals and how they are cooperating with new companies to accelerate change. Here is what they are doing right now (in random order).

Of course, this is not meant to be exhaustive. If you want to take a deep dive into healthcare corporate venturing, feel free to contact me: sofie@dashplus.be.

1.CHU Lille (France)

CHU Lille is the largest health campus in Northern Europe. It has a team of +15 000 health professionals and treats over 1,4 million patients every year. Innovation and international collaboration is a priority for this hospital close to Belgium and the UK.

Patient experience and high-tech medical platforms are at the core of the CHU Lille investment strategy. Their innovative approach is focused on cardio- metabolism, inflammatory diseases, neurosciences, cancer and health techniques.

Since 2008, CHU Lille has selected and supported +103 innovation projects that reached 10k patients. They cooperate with 14 startups right now.

2. Mater University Hospital Dublin

Mater University Hospital has 600 beds and a dedicated innovation strategy and is building services and infrastructure for new ventures.

The hospital incorporates a dynamic transformation office that guides all joint- ventures. Mater ventured with a.o. SilverCloud and CliniShift.

Their ‘Pillar centre‘ will be the location to cooperate with even more businesses from 2021 on.

They are interested in sustainable development solutions for water, energy and food within the hospital.

3.Capio (Sweden) and Ramsay Santé (Europe)

The originally Swedish healthcare group Capio has a tradition of cooperation and innovation to guarantee ‘the best achievable quality of life for every patient‘.

Continuous improvement and commitment to patient needs have always been a cornerstone in the model of the Nordic medical, chirurgical and psychiatric health group. That’s why they cooperated with Doctrin for example.

Since Capio was acquired by French Ramsay Santé in December 2018, the importance of venturing has only grown. Ramsay Santé is a leading European healthcare group with over 22 000 health professionals.

It builds partnerships around digitalisation, optimization, talent and integrated care. It has an innovation hub and supports several innovations trough dedicated foundations, for example on health prevention.

4.Maria Middelares Ziekenhuis (Belgium)

This Belgian middle-size general hospital cooperates with 15 startups right now, one of them being MoveUp, a digital health knee and hip-rehabilitation programme, in which they also invest corporate venturing capital.

Maria Middelares and her dynamic management team were among the first Belgian hospitals to make a dedicated outside-in innovation strategy. The big driver? The wish to increase patient value. All venturing activities at Maria Middelares should be value-based and deliver a better quality of life for the patient at the lowest cost.

Management is very dedicated to a 3-step model: first waste in the hospital has to be away, then the digital shift is necessary and this will lead to higher patient value. A dedicated budget supports this innovation strategy.

Venturing activities are focused on telehealth, artificial intelligence and integrated care, and not on specific medical departments. They all involve multidisciplinary teams within the organisation.

5.AZ Delta (Belgium)

The general hospital AZ Delta will open a brand new campus this spring. It will incorporate RadAr, an open innovation and teaching centre, where AZ Delta is planning to cooperate with partners on mobile health, artificial intelligence and smart food.

6.In4care (Belgium)

In4care is a membership community of several Belgian hospitals with an aim to bring innovation awareness into the sector. As such, they organise inspiration round tables, seminars and yearly innovative competition. But there is more.

A daughter of In4care, BC10, is preparing to be transformed into a corporate venturing investment fund. This way, BC10 could be Belgian’s first group hospital venturing fund: multiple hospitals cooperating for their outside-in innovation activities. 1 Compared to the Qbic fund of research institutions that’s investing in inside-out innovation.

7.Nextgen ventures (the Netherlands)

This corporate venturing fund is a cooperation of 2 private healthcare insurers (Menzis and De Friesland zorgverzekeraar), 1 innovation foundation (Noaber foundation, which is related to Philips) and 1 hospital (UMC Groningen by the Triade foundation). They have joined forces to accelerate the implementation of personalised, integrative high-quality care by investing in health startups.

They invest in Dutch startups in health ICT, medical devices and domotica. They typically invest 400k and they currently have a portfolio of 8 investments, including for example Plasmacure and leQuest.

They are always eager to find startups that contribute to VBHC, healthy ageing, and (if possible) self-management.

8.Sant Joan de Déu Pediatric Hospital Barcelona (Spain)

SJD child hospital pioneered in 2009 when it was the first hospital in Spain to start a department devoted to specifically driving innovation. This was based on ‘Phairos’, the consecutive strategical plans of SJD to transform from a general hospital into a world-leading hospital for child and mother care.

In 2010 it appointed Jorge Juan Fernandez as probably the first director of digital health in Europe. Fernandez, who is also innovation director at EIT Health, today is still responsible for what is called at SJD ‘the liquid hospital’: over 30 projects seeking to radically transform healthcare through intensive use of technologies oriented towards the patient

SJD has worked with more than 100 startups and international companies now. About 45% of all innovation projects in the hospital are venturing activities. Today, SJD invests in 3 startups and has 7 licences for use.

They have build collaboration ecosystems with universities, communities like Kid’s cluster and entrepreneurial programs like Tech4health.

SJD is working in these 5 areas:

- Pharmaceutical products.

- Materials and devices.

- ICT and Health.

- Organizational and care.

- Biotechnology and molecular diagnostics.

9.Ziekenhuis Oost-Limburg (Belgium)

Also called ZOL, is a general hospital with 811 beds in Flanders, the northern part of Belgium. In 2016 and based on its strategy to build a future-proof hospital, ZOL started with a ‘future health’ department. This is mainly a research and a clinical trials facility, supporting both researchers and startups to test and receive clinical validation for new products.

The future health team at ZOL is working as a portal and touchpoint for innovators: they support and guide them through the legal, administrative, and technical process of clinical trials in the hospital. Also, they negotiate partnership agreements.

In case validation trials with partners are successful, ZOL decides upon internal valorisation in the hospital: how to learn and implement the lessons from the validation trials into the hospital care paths?

ZOL is interested in venturing activities in cardiology, oncology, gynaecology, orthopaedics and anaesthesia. For example, Belgian cardiological app Fibricheck is a spin-off from ZOL and they are also cooperating with Bloom.

10.HUS Helsinki University Hospital (Finland)

HUS group as a hospital network is the biggest healthcare provider and the second-largest employer in Finland.

Like all university hospitals, HUS (Helsinki University Hospital) has extended clinical trial facilities and research activities. HUS cooperates with companies in a multitude of ways, like for example with Buddy Healthcare, a Finnish startup automating care pathways.

HUS is also impressive because of its large Nordic ecosystem for joint ventures in the world’s number 2 country for startups and digital maturity. It’s one of the leading Nordic hospitals in terms of connection to higher education, accelerators and business hubs like Helsinki Business Hub and Norway Health Tech.

HUS has invested in a framework and dynamic process for cooperation with private companies and tries to make joint ventures as iterative and effective as possible. The HUS-framework describes the collaboration model, common principles, rules, responsibilities, roles, resources, timelines and the progression of a collaboration.

To wrap-up

This list of 10 is a selection of the joint-venture activities of hospitals in Europe I encountered. Corporate venturing is definitely gaining attention as a strategic path to innovation for European hospitals too.

In particular general hospitals think about venturing activities to build new services and new business models. While university hospitals start from their R&D and clinical trial services.

Some hospitals have made very broad thematic choices, others focus on key medical fields. This is important for startups and corporates looking for cooperation.

Not many European hospitals have their own investment fund yet. This is way out of the core expertise of hospital managers and the financial risk is not to push aside.

The question of the impact you can have with corporate venturing activities, and what it takes to be successful, will be the topic of the last blog in this series.

Subscribe to our two-weekly newsletter (it’s FREE) in case you don’t want to miss it!

Wandering to (re)build hospital venturing activities? You can download a free checklist here to see what it takes.

dashplus helps healthcare companies to build corporate innovation. We offer trusted advice, tools and diverse workshops. Please feel free to contact me to collaborate for your organisation: sofie@dashplus.be.