Introduction

In 2023, Belgian healthtech startups and scaleups attracted investments worth a total of €258 million. Since 2016, in general, Belgian startups have seen a significant 43% increase in capital raised, as reported by Statista.

And although 2023 marked stagnation after exceptional health tech years all over Europe, Belgium has solidified its reputation within the European venture capital scene, strengthening its position as a hub for startup investments in recent years.

This is due to a number of factors, including:

- The rise of angel investors: Angel investors are high-net-worth individuals who invest their own money in early-stage startups. The number of angel investors in Belgium has increased significantly in recent years, providing startups with a valuable source of funding.

- A strong technological infrastructure: Belgium has a strong technological infrastructure, including reliable internet connectivity and a skilled workforce with the necessary technical skills. This infrastructure is essential for supporting the development and adoption of new technologies.

- A dense startup health network: Belgium has a dense startup health network, including incubators, accelerators, and other organizations that support the growth of healthcare startups. This network provides startups with access to resources and expertise that can help them succeed.

These strengths offer opportunities for both Belgian and international healthcare venture funds and for startups and scaleups in health.

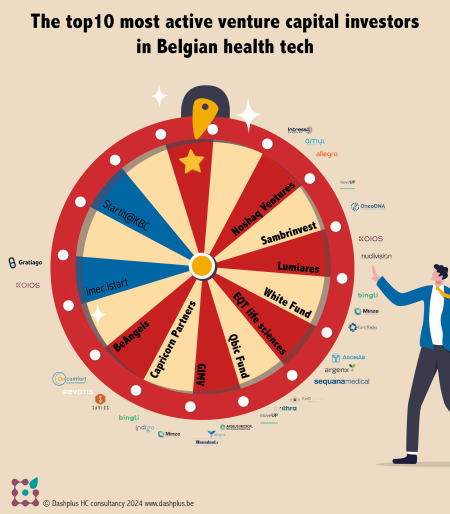

Explore the top10 investors

Here are the top 10 most active venture capital investors in Belgian healthtech in 2023:

Download the full list and explore more details on the focus and portfolio of the top 10 investors:

What can we learn from this list?

The Belgian healthtech startup ecosystem is supported by a robust network of angel and seed investors, with some life science VC firms and VC funds having consistently bet on Belgian lifesciences and healthcare technologies.

Startups that are looking for early-stage funding can often find it close to home. Public investment funds play an important role in this. Players like Vlaio, Sambrinvest, Wallonie Entreprendre, and Imec.istart are a strong point of contact for health startups in Belgium.

The Qbic fund supports spin-outs from all universities in health.

The really big international investors in health, such as Sequoia Capital (California, Series A), Antler (Singapore, seed), Kohsla Ventures (California, series A), SOVS ( New Jersey, seed), and even BPI France (Paris, seed) and High-tech Gründerfonds (Bonn, seed and series A), have not yet discovered the Belgian health ecosystem.

Startups and scaleups that attract international investors seem most likely to find a partner with VC funds that target an internationally diversified portfolio and have a keen interest in Belgian healthtech investments.